DEAR TAXPAYER,

1. REGISTERATION AND BASIC INFORMATION

1.1 HOW TO RETRIEVE USERNAME/PASSWORD?

1.1.1 CASE 1: YOU REMEMBER YOUR PASSWORD BUT DON'T RECALL THE USERNAME-

- GO TO GST PORTAL WWW.GST.GOV.IN

- CLICK ON LOGIN BUTTON

- YOU CAN FIND FORGOT USERNAME BUTTON AT THE BUTTON OF THE PAGE, CLICK ON THE SAME.

- THE NEXT PAGE WILL OPEN. ON THAT PAGE, SUBMIT YOUR GST REGISTERATION NUMBER (GSTIN).

- YOU WILL RECEIVE AN OTP ON YOUR REGISTERED MOBILE NUMBER AND REGISTERED EMAIL ID.

- ENTER YOUR OTP IN THE GIVEN SPACE AND CLICK ON THE SUBMIT BUTTON.

- YOU WILL RECEIVE YOUR USER ID IN YOUR EMAIL.

1.1.2 CASE 2: YOU HAVE FORGOTTEN YOUR PASSWORD-

- GO TO GST PORTAL WWW.GST.GOV.IN

- CLICK ON LOGIN BUTTON

- YOU CAN FIND FORGET PASSWORD BUTTON AT THE BOTTOM OF THE PAGE, CLICK ON THE SAME.

- THE NEXT PAGE WILL OPEN, IN THAT PAGE, SUBMIT YOUR USERNAME. THEN CLICK ON GENERATE OTP BUTTON.

- YOU WILL RECEIVE AN OTP ON YOUR REGISTERED EMAIL ID AND AND REGISTERED MOBILE NUMBER.

- ENTER YOUR OTP IN THE GIVEN SPACE AND CLICK ON SUBMIT BUTTON.

- ENTER NEW PASSWORD IN THE GIVEN BOX. THE, RE-ENTER THE SAME PASSWORD. THE PASSWORD SHOULD BE OF 8 TO 15 CHARACTERS WHICH SHOULD COMPRIES OF AT LEAST ONE NUMBER, ONE SPECIAL CHARACTER, ONE UPPER CASE AND ONE LOWER CASE LETTER. THEN, CLICK ON THE SUBMIT BUTTON.

- YOU WILL RECEIVE A CONFIRMATION THAT YOUR PASSWORD HAS BEEN RESET SUCCESSFULLY ON YOUR REGISTERED EMAIL ID.

1.2 HOW TO MAKE NON-CORE AND CORE AMENDMENTS IN REGISTERATION?

WHILE APPLYING FOR GST REGISTERATION, YOU MUST HAVE PROVIDED CERTAIL DETAILS IN THE REGISTERATION FORM. YOUR REGISTERATION HAS BEEN GRANTED ON THE BASIS OF THE INFORMATION PROVIDED AND SUPPORTING DOCUMENTS UPLOADED BY YOU. IN CASE INFORMATION PROVIDED BY YOU AT THE TIME OF REGISTERATION GETS CHANGED, YOU NEED TO AMEND THE INFORMATION IN YOUR REGISTERATION DETAILS. THE PROCESS OF MAKING CHANGES IS CALLED AMENDMENT. IT IS TWO TYPES NAMELY, CORE AND NON CORE AMENDMENT. YOU NEED TO UNDERSTAND THE CONCEPT OF CORE AND NON CORE AMENDMENT.

- ANY CHANGES IN THE NAME OF BUSINESS (IF THERE IS NO CHANGES IN THE NAME AS RECORDED ON PAN)

- PRINCIPAL PLACE OF BUSINESS.

- ADDITIONAL PLACE OF BUSINESS (OTHER THAN CHANGE IN STATE)

- ADDITION OR OR DELETION OF PARTNER, KARTA, MANGING DIRECTOR, WHOLE TIME DIRECTOR, CHIEF EXECUTIVE OFFICER ETC..

1.2.1.: THE PROCEDURE FOR THE AMENDMENT OF NON CORE FIELDS IS AS FOLLOW:

- LOGIN TO THE GST PORTAL WITH YOUR USER ID AND PASSWORD

- UNDER SERVICES TAB CLICK REGISTERATION ---- AMENDMENT OF REGISTERATION NON-CORE FIELDS.

- THE APPLICATION FOR CHANGE IS DISPLAYED AND NON CORE FIELDS ARE AVAILABLE IN EDITABLE FORM.

- SELECT THE APPROPRITE TAB WHICH YOU WANT TO CHANGE / AMEND.

- AFTER DOING CHANGES, CLICK ON VERIFICATION TAB,

- SELECT THE AUTHORIZED SIGNATORY FORM THE DROP DOWN.

- ENTER THE PLACE.

- AFTER THE APPLICATION IS FILLED, YOU HAVE TO AUTHENTICATIE THE APPLICATION OR DIGITALLY SIGN THE SAME USING DSC OR EVC.

- A MESSAGE WILL BE DISPLAYED SHOWING THAT THE SUBMISSION IS SUCCESSFUL.

- YOU WILL RECEIVE AN ACKNOWLEDGEMENT WITHIN 15 MINUTES REGISTER EMAIL ID AND MOBILE NUMBER. ALSO, THE EMAIL AND MESSAGE CONTAINING ARN AND INTIMATION ABOUT SUCCESSFUL FILLING OF APPLICATION FORM FOR AMENDMENT OF NON CORE FIELDS WILL BE SENT TO PRIMARY AUTHORIZED SIGNATORY.

- ON APPROVAL OR REJECTION OF THE APPLICATION BY THE TAX OFFICER, YOU WILL RECEIVE A NOTIFICATION THROUGH SMS AND EMAIL.

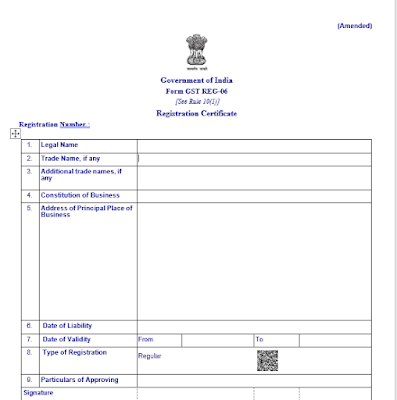

1.3 : YOUR REGISTERATION CERTIFICATE

EVERY REGISTERED TAXPAYER IS ISSUED A GST REGISTERATION CERTIFICATE IN FORM GST REG -06 YOU CAN DOWNLOAD THE REGISTERATION CERTIFICATE FROM THE GST PORTAL. THE REGISTERATION CERTIFICATE IS AVAILABLE FOR DOWNLOAD ON THE GST PORTAL. GOVERNMENT DOES NOT ISSUE ANY PHYSICAL CERTIFICATE. YOU CAN DOWNLOAD YOUR REGISTERATION CERTIFICATE BY FOLLOWING SIMPLE STEPS. AS GIVEN BELLOW.

- LOGIN TO GST PORTAL

- GO TO SERVICES > USER SERVICES > VIEW/DOWNLOAD CERTIFICATE.

- CLICK ON DOWNLOAD ICON.

- THE CERTIFICATE CONTAINS ALL THE DETAILS OF THE BUSINESS. IN THE FIRST PAGE OF THE REGISTERATION CERTIFICATE, DETAILS SUCH AS GSTIN, NAME , ADDRESS , DATE OF REGISTERATION ETC.. ARE DISPLAYED.

- THE SECOND PAGE IS 'ANEXURE A ' WHICH HAS DETAILS OF ADDITIONAL PALCE(S) OF BUSINESS. IF ANY.

- THE THIRD PAGE 'ANEXURE B ' HAS INFORMATION OF THE PERSON IN CHANGE OF THE BUSINESS.

- YOU MUST TAKE A PRINT OUT OF THE FIRST PAGE OF YOUR REGISTERATION CERTIFICATE AND DISPLAY IT PROMINENTLY AT YOUR BUSINESS PREMISES.

.png)

.png)

Osm Directory

ReplyDeletePost is greate for newly taxpayer😍

ReplyDeletegreat

ReplyDelete